Advanced Audit Monitoring &

Tax Resolution Software

Empowering CPAs, EAs and Tax Attorneys with

unparalleled efficiency and accuracy.

A Tax Pro’s Best Friend

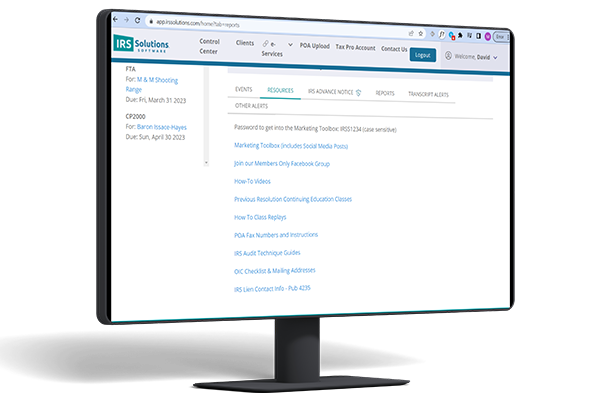

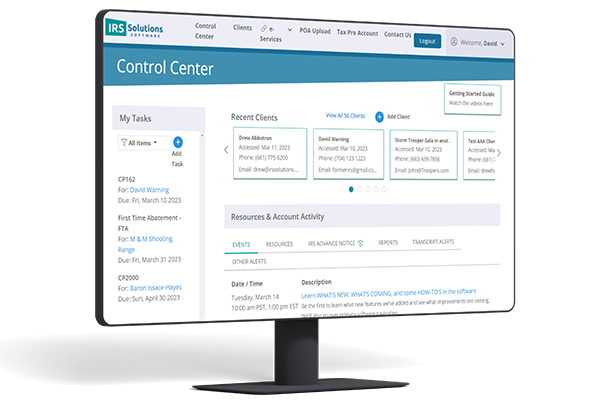

Skillfully manage tax resolution cases with the integrated IRS Solutions software platform and membership package.

IRS Solutions makes it easier than ever to operate and expand a tax resolution practice. Other companies provide only software but we offer so much more.

Our members enjoy access to the marketing tools, free continuing education, and the advice from former IRS officers that they need to succeed – all within a supportive community of peers.

Designed for Tax Pros by Tax Pros.

Our Members Benefit from our Experience.

IRS Solutions has been created with an insider’s understanding of you and your clients. Every component has been designed to maximize efficiency, consistency, and professionalism, from our intuitive automation to our white-glove customer support.

![]()

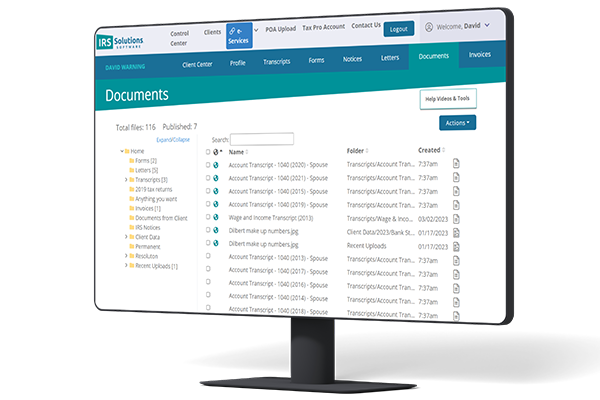

You don’t have time to spare. With IRS Solutions, all you have to do is put a notice code or letter number into the system and sit back while it clarifies the next steps. Download transcripts with ease and let the software turn them into client-friendly documents that even a layman can understand.

IRS Solutions membership includes accredited live classes on a range of topics taught by tax resolution veterans. Gain valuable insight from our experts while earning Continuing Professional Education (CPE/CE) credits toward your annual requirement.

![]()

IRS Solutions members expand their practices with our exclusive Marketing Toolbox, a suite of resources, including copy-and-paste social media posts, email communications, and professionally-designed one-page promotional handouts.

Accomplish More in Less Time with our Comprehensive

Tax Resolution Software Tools

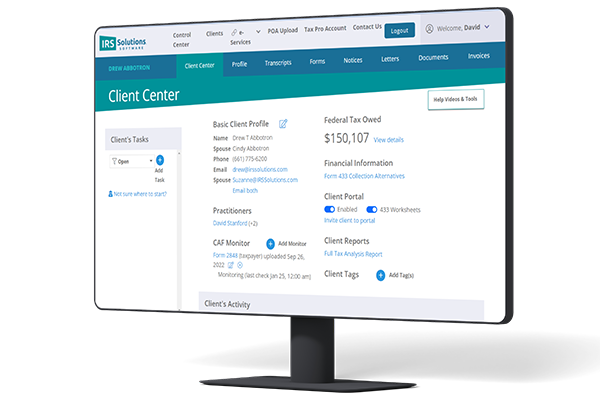

Tax Resolution Management

Make managing complex tax resolution cases easy and profitable:

- Full integration with IRS systems

- Automatic transcript downloads

- Instant analysis

- Solution recommendations

- Power of Attorney and Tax Information Authorization

- Bankruptcy discharge date calculation

- First time penalty abatement

- Notifications to your email of transcript changes

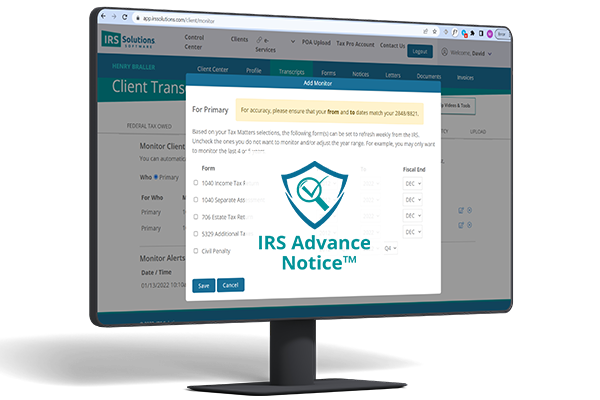

IRS Advance Notice™ (IAN)

Monitor transcript activity and get notifications for:

- Possible audits (notification six months before your client is ever notified)

- Federal tax liens

- Installment agreement changes

- OIC activity

- Passports certified to the Secretary of State

Client Management

Take better care of more clients with the following:

- Custom-branded communications portal

- Built-in customizable file management system

- Tax analysis reports

- Easy-populating, embedded forms

- Control center reminders

Growth Solutions and Member Support

Choosing IRS Solutions is like bringing on the best silent partner – one who invisibly helps your business thrive every day:

- Easy onboarding and customer support

- Ongoing training and orientation

- Continuing Education classes for EAs & CPAs

- Marketing Toolboxes to promote your business with regularly-updated assets

- Active professional community

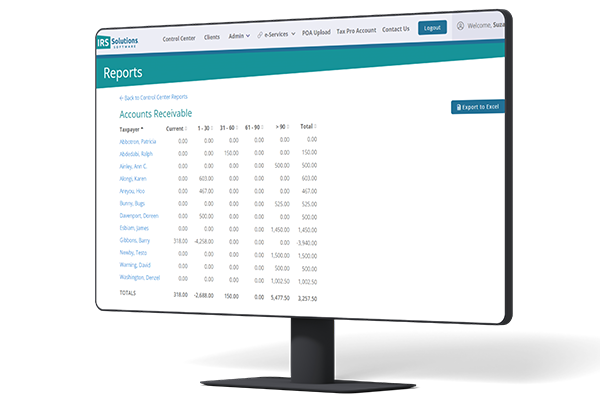

Invoicing and Payments

Easily manage billing and receivables:

- Customizable invoicing

- Track receivables and balances

- Payment processing

Data Security

- SOC 2® Compliant

- AWS Government Cloud (AWS GovCloud)

- 256-bit AES encryption and TLS 1.2+

- Continuous backups with built-in redundancy

- Stable, reliable platform

- All programming is done in the USA

Try IRS Solutions® 100% Risk-Free

Let us show you how IRS Solutions can transform your tax practice.

What Do Tax Pros Say About IRS Solutions®?

Tax resolution specialists, CPAs, Enrolled Agents, accounting professionals, attorneys

and even ex-IRS agents all praise IRS Solutions.

Partnerships and Integrations

We work with the tax industry’s best and have developed a network of partnerships and integrations,

united by a shared commitment to provide cutting-edge resources for tax professionals.