Other companies provide only software. We offer so much more.

Skillfully manage tax resolution cases with the integrated IRS Solutions software platform and membership package.

Take a closer look…

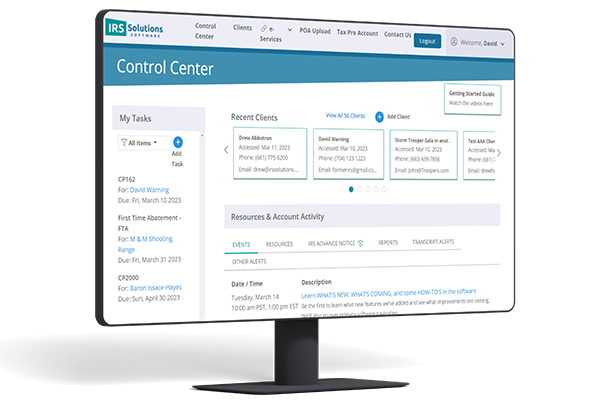

Accomplish More in Less Time with our Comprehensive Suite of Tools

Tax Resolution Management

Make managing complex tax resolution cases easy and profitable:

- Full integration with IRS systems

- Automatic transcript downloads

- Instant analysis

- Solution recommendations

- Power of Attorney and Tax Information Authorization

- Bankruptcy discharge date calculation

- First time penalty abatement

- Notifications to your email of transcript changes

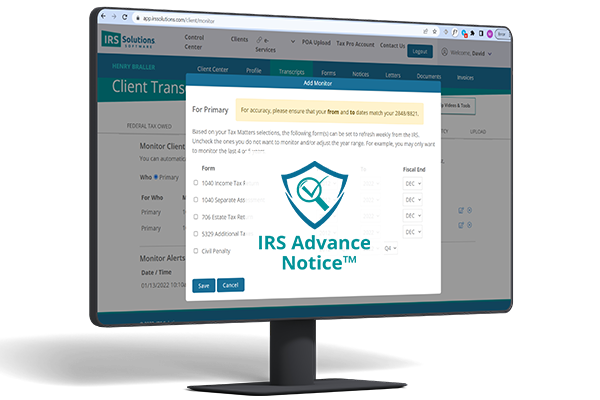

IRS Advance Notice™ (IAN)

Monitor transcript activity and get notifications for:

- Possible audits (notification six months before your client is ever notified)

- Federal tax liens

- Installment agreement changes

- OIC activity

- Passports certified to the Secretary of State

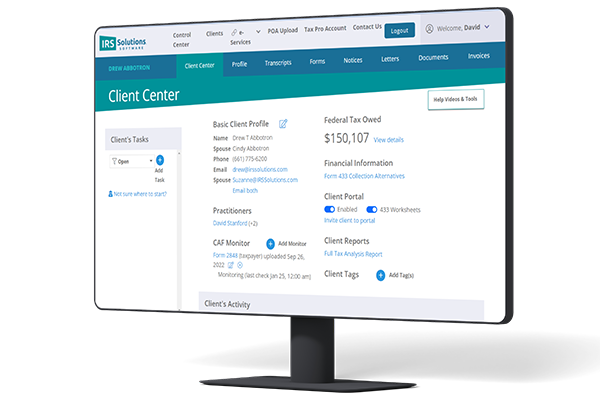

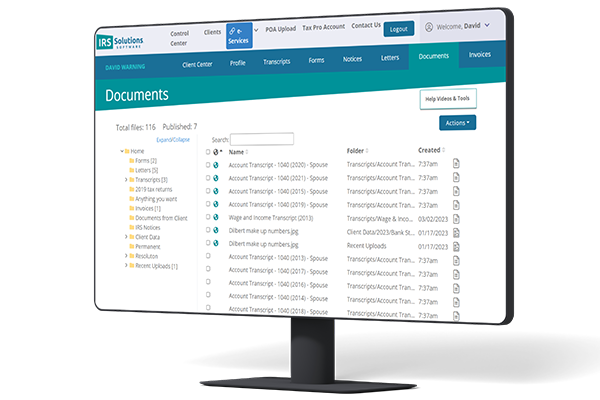

Client Management

Take better care of more clients with:

- Custom-branded communications portal

- Built-in customizable file management system

- Tax analysis reports

- Easy-populating, embedded forms

- Control center reminders

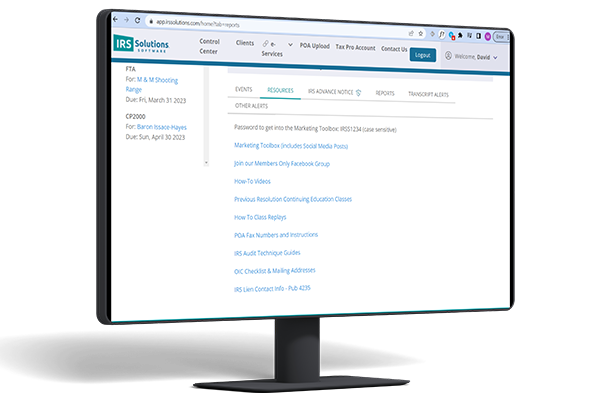

Growth Solutions and Member Support

Choosing IRS Solutions is like bringing on the best silent partner – one who invisibly helps your business thrive every day:

- Easy onboarding and customer support

- Ongoing training and orientation

- Continuing Education classes

- Marketing Toolboxes to promote your business with regularly-updated assets

- Active professional community

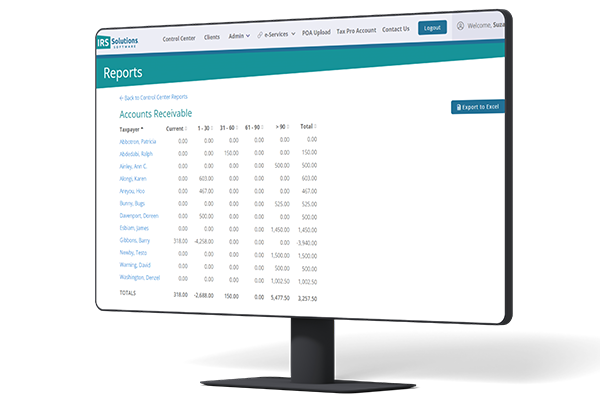

Invoicing and Payments

Easily manage billing and receivables:

- Customizable invoicing

- Track receivables and balances

- Payment processing

Data Security

IRS Solutions prioritizes your data security:

- AWS Government Cloud (AWS GovCloud)

- We use the latest technology to safeguard your data: 256-bit AES encryption and TLS 1.2+

- Continuous backups with built-in redundancy

- Stable, reliable platform

- All programming is done in the USA

Try IRS Solutions® 100% Risk-Free

Let us show you how IRS Solutions can transform your tax practice.

What Do Tax Pros Say About IRS Solutions®?

Tax resolution specialists, CPAs, Enrolled Agents, accounting professionals, attorneys

and even ex-IRS agents all praise IRS Solutions.

"IRS Solutions has been instrumental in the success and expansion of our firm in the tax representation arena. We estimate that IRS Solutions has reduced our IRS representation workload by approximately 30%, giving us additional time and resources that can now be spent assisting our clients."

Joe Serrone EA, Partner

Polaris Tax & Accounting

"The software has saved me hours upon hours of work that I would have been doing manually. I love the software because of its affordability. It allows capacity for me to expand to add additional users as my business will grow in the future."

Kenneth Walters

The Crystal Group Tax Business Services

"The support is absolutely unmatched. If I have a question, I can reach the owners by phone, email, or even on Facebook. They are there to help me every step of the way, they solicit feedback to make the program better, and they actually care about me and my practice."

Chris Goss

The Goss Firm – Tax Advocacy and Representation

"I like that I can track all of my clients with POAs and monitor certain clients for changes to their transcript and balances."

Michael Rosen

Senior Tax Manager

"The transcript download with IRS Solution Software makes my life easier and there were no additional fees to use it! Thank you for thinking of us in designing this software."

Samantha Singletary

Talkstax Group

"Having IRS Solutions at my side has increased my representation revenues by over 50% while cutting down the time spent on such projects by almost 30%."

Raymond Sawyer, EA, CTC

Sawyer One Stop Accounting & Tax