Say Hello to Increased Productivity and Goodbye to Manual Interventions

Accelerate enterprise growth with workflows designed for enterprise speed and accuracy.

- Manage hundreds of cases simultaneously with enterprise-grade tools, onboarding, training, and U.S.-based expert support included in one annual membership fee. No hidden fees or add-ons.

- Faster resolution through instant analysis and optimized solution recommendations that streamline Offers in Compromise, Installment Agreements, and Currently Not Collectible; calculators such as bankruptcy discharge date reduce manual effort across large caseloads.

- Proven usability at scale, with independent reviews highlighting ease of use and productivity gains that lower training time and improve adoption across large user groups.

- Enterprise-grade security and data residency on AWS GovCloud with encryption, two-factor authentication, and continuous backups – so sensitive taxpayer data stays in the United States. With SOC 2®, FedRAMP High, and IRS 1075 compliance, IRS Solutions aligns with the security and regulatory standards enterprise firms are required to meet.

Leave Your Competition Behind

IRS Solutions® empowers enterprise tax firms to collaborate flawlessly, resolve cases rapidly, and deliver elite service at every client touchpoint.

End-to-End Tax Resolution Software for Enterprise Tax Firms

Industry-leading features, unmatched usability, and scalable automations all make IRS Solutions the best option for large firms seeking the right tax resolution platform.

- Automated Reports: Spot issues early and reduce rework. Track passport holds, tax account issues, Trust Fund Recovery Penalties (TFRP), Wage and Income Discrepancies, and more.

- Client-Facing Tax Analysis Report: Summarize client positions and options for resolution.

- Built-In Forms: Give every team member quick access to hundreds of forms and 40+ POAs they need to work efficiently.

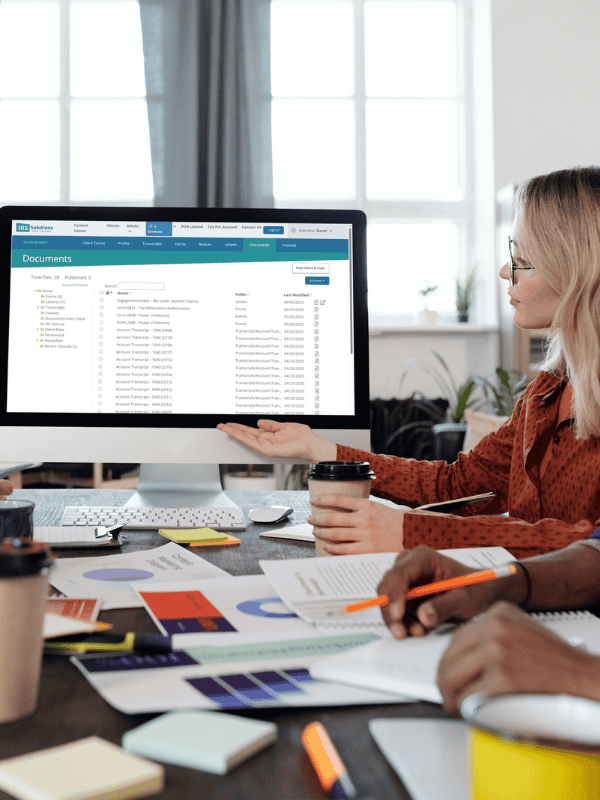

- Secure Document Storage: House all relevant documents and case notes in one easily accessible location.

Speed through case work with direct IRS access and efficient workflows. Turn proactive monitoring into recurring revenue with IRS Advance Notice™ early alerts.

- Direct Connection: Communicate instantly with the IRS Transcript Delivery System (TDS).

- Bulk Transcript Capabilities: Download up to 100,000 IRS transcripts per hour and analyze them in bulk.

- Proactive Client Transcript Monitoring and Analysis: Eliminate time spent logging into the IRS system and sifting through data for changes.

- Automated Email Alerts: Customize which transaction codes trigger notifications for each client.

- Scalable Features: There are no surprise fees or extra billing per alert, no matter how big your enterprise tax firm grows.

- Year-Round Revenue Stream: Transition clients to a renewing, subscription-based tax health plan, including ongoing transcript monitoring.

IRS-Connected for Smooth, Simple Transcript Workflows

All-Inclusive, Enterprise-Class Service

IRS Solutions is more than software. We’re a true partner fully invested in your enterprise tax firm’s success.

- Dedicated Account Management: Always know who you’re working with. Reach out with questions or needs at any time. We’re here to help.

- White-Glove Tech Support: When you call or email, our on-shore experts will be ready with the quick answer you need.

- Free Continuing Education Workshops: Keep team members up to date on their certifications with monthly CPE credit classes.

- Networking and Mastermind Groups: Connect with other enterprise tax firm pros to share ideas, tips, and solutions.

Try IRS Solutions® 100% Risk-Free

Let IRS Solutions Do the Heavy Lifting for Your Enterprise Tax Firm.

What Do Tax Pros Say About IRS Solutions®?

Enterprise tax, financial, and legal firms all praise IRS Solutions.

"I love how easy it is to use! I've used similar products in the past, but they were always so clunky and "overdone." IRS Solutions is easy to use, easy to navigate, and doesn't overwhelm the user with filler that isn't necessary. There isn't a long learning curve, as much of the platform is easy to figure out. We use it daily with great success!"

Morgan A.

CEO, Golden Lion Tax Solutions

Tax Resolution Software for Professionals

Accomplish more in less time with our comprehensive suite of tools.

Tax Resolution Management

Make managing complex tax resolution cases easy and profitable:

- Full integration with IRS systems

- Automatic transcript downloads

- Solution recommendations

- Power of Attorney and Tax Information Authorization

- Bankruptcy discharge date calculation

- Notifications of changes

IRS Advance Notice™ (IAN)

Monitor transcript activity and receive advance notification as much as six months ahead of changes:

- Possible audits

- Federal tax liens

- Installment agreement changes

- OIC activity

- Delinquent passports

Client Management

Take better care of more clients with:

- Custom-branded communications portal

- Built-in file management system

- Tax analysis reports

- Easy-populating, embedded forms

- Control center reminders

Invoicing & Payments

Easily manage billing and receivables:

- Customizable invoicing

- Track receivables and balances

- Payment processing

Growth Solutions & Support

A silent partner who invisibly helps your business thrive every day:

- Easy onboarding

- Ongoing training

- Marketing toolbox

- Professional development

Data & Security

IRS Solutions prioritizes your data security:- AWS Government Cloud

- 256-bit AES encryption and TLS 1.2+

- SOC 2® Compliant

Partnerships and Integrations

We work with the tax industry’s best and have developed a network of partnerships and integrations,

united by a shared commitment to provide cutting-edge resources for tax professionals.