Partner Rewards Program

Become a Rewards Partner Today

Generate Revenue When You Share IRS Solutions Software

with Your Professional Network

Apply Now:

It’s as Easy as 1-2-3

![]()

It only takes 5 minutes to join our tax affiliate program. Once approved, we’ll give you everything you need to turn referrals into revenue.

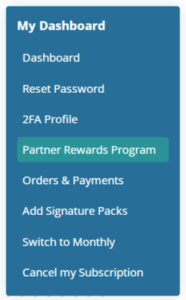

Members: Log into your account and join under Settings → Manage My Subscriptions → Partner Rewards Program.

![]()

Use your personalized link and banners to let your colleagues know how much time and effort you save with IRS Solutions. When someone signs up via your referral link, you’ll automatically get the credit.

![]()

Sit back, relax, and watch those reward dollars land in your PayPal account. Every successful referral earns you a flat fee on initial payments and 5% on recurring orders for the next 24 months.

Why Become a Reward Partner?

Low Effort, High Compensation

With a generous flat commission on first orders, and 5% on recurring orders for the next 24 months, rewards add up quickly. The number of referrals you can make is unlimited!

Marketing Support

Look good every time you recommend IRS Solutions. We’ll supply you with professionally created, high-quality marketing materials.

Real-Time Tracking

Monitor your referrals and earnings through an advanced, easy-to-use dashboard. There are dedicated tabs for your referrals, payments, and traffic generated via your links.

Fast Payouts

Enjoy consistent payments deposited directly into your PayPal account.

Personalized Affiliate Links

Get credit for every referral with custom links for tracking and promotion.

Dedicated Support Team

We’ll always be there to answer questions and help you maximize your referrals. Call us during business hours. We’ll pick up the phone.

Partner Rewards Program Details

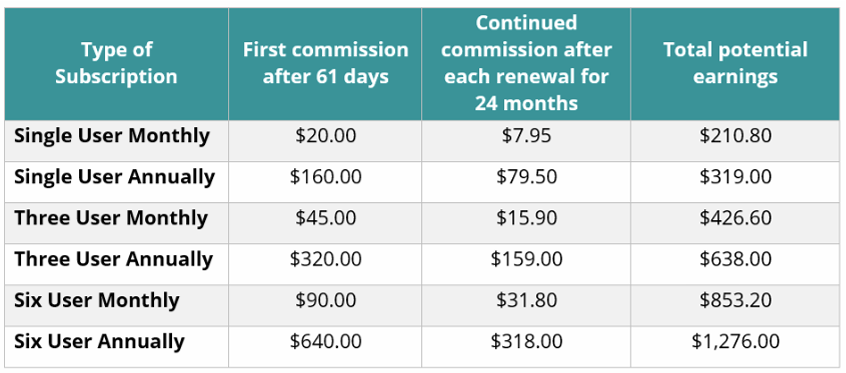

How much extra cash can you add to your income with the IRS Solutions Partner Rewards Program?

Rewards Partners receive a predetermined dollar-amount commission on initial payments and 5% on recurring orders from referrals for the IRS Solutions Software’s Annual and Monthly Subscriptions.

The Fine Print:

- Referral fees are paid for two years or 24 months of signup.

- Commission is paid on the initial subscription that does not have any interruption in service.

- First commission payout will occur after 60 days, and the money- back guarantee has ended.

Apply Now:

Members: Log into your account and join under Settings → Manage My Subscriptions → Partner Rewards Program.

Frequently Asked Questions

Program Details

Anyone in the tax professional field is eligible to join. We invite IRS Solutions members and industry professionals to join the program and start earning immediately.

It’s easy! Fill out a quick application today.

Log into your account and join under Settings → Manage My Subscriptions → Partner Rewards Program.

We’ll get back to you with approval or a few more questions as soon as possible.

It’s easy! Fill out a quick application today. We’ll get back to you with approval or a few more questions as soon as possible.

No tax resolution platform has a better industry reputation. Visit our Capterra Reviews page and Member Success Stories page to learn about our unparalleled software quality and unrivaled commitment to member service. We invite and encourage you to read what users say about IRS Solutions. We’ve worked hard to earn those recommendations and are proud of them.

Click here for the Partner Rewards Program Terms of Service.

Yes! IRS Solutions Software Rewards Program is fully GDPR compliant. The program does not store or process your visitors’ personal data and only uses 1st-party cookies.

Partners are limited to a single account within the IRS Solutions Rewards Partner Program.

Commissions

Unlike other tax affiliate programs, IRS Solutions Partner Rewards doesn’t pay you in subscription credit. We offer an income stream for you to use in whatever way works best for you, paid promptly via PayPal. Payments are made once per month for the previous month’s sales. Or in the case of your first sale, there will be a 2-month delay.

We use cookies to track sales from your referrals accurately. Ensure your links are correctly formatted with the provided HTML code, and remind your referrals to keep cookies enabled to guarantee you receive credit for sales.

Partner Rewards are offered on initial memberships and renewals that occur without an interruption in service. If your referral cancels their subscription or fails payment on their subscription and then returns, that new subscription is ineligible for Partner Rewards.

You have the flexibility to choose whether commissions are paid to you personally or to your company when you connect your PayPal account.

Our system updates in real-time, ensuring that any sales attributed to your referrals will be promptly reflected in your account statistics.

Residual commissions are earned when customers you’ve referred renew their annual or monthly subscriptions through us. These are automatic and ensure continuous earnings as long as your referrals maintain their subscriptions.

No, self-referrals are not permitted and are blocked.

Our program does not require a minimum earning threshold for payouts. Your earned commissions from the previous month are paid the subsequent month.

All partners are required to handle their tax obligations on referral earnings. PayPal will process a Form 1099 (if required) and any other documentation required for taxes.

As a valued member of the IRS Solutions Rewards Partner Program, you will have access to your personal dashboard, which offers breakdowns of purchases that have been attributed to your links, payouts, and website traffic you have sent using your links.

Creatives & Referral Links

It’s essential to embed your affiliate links or banners in sections of your site that receive the most visibility and traffic. Ideal placements include high-visibility areas like your web pages’ top, bottom, or sides. Select a location that you believe will most effectively capture the attention of your site visitors.

To incorporate a banner into your website, please follow these steps: (1) Access your IRS Solutions Rewards Partner Program account by logging in. (2) In the Creatives Tab of your Dashboard, select from the available banners or links. (3) Choose your preferred link and embed it directly onto your site. Downloading the graphics to your device is unnecessary, although the option to download is also available.

Even without a website, you can effectively share your referral links and earn rewards:

- Email Campaigns: Incorporate your personalized referral links in emails to colleagues. Highlight how IRS Solutions has helped you save time and effort, encouraging them to check it out.

- Online Networking Groups: Share your referral links in discussions or direct messages within professional online networking groups.

- Social Media: Post about your positive experiences with IRS Solutions on social media, using your referral link to invite others to join.

When a visitor arrives at your site through your custom link, our IRS Solutions Rewards Partner Program tracks that an affiliate referred the visitor. If the visitor makes a purchase, the referring Partner is credited with the sale, which is recorded as a referral in our system. Your custom links, which already include your unique identifier, can be found in the Creatives section of your Dashboard. This unique parameter ensures the visitor’s actions are linked to your Rewards Partner account. You can monitor this traffic via the Traffic Tab in the Dashboard. Note: If the visitor clears their cookies or clicks on a link from another Rewards Partner, it will override your link.

Account Management

Should you face any issues with your login credentials, use the “forgot password” option for a reset or contact us for further assistance at (844) 447-7765.

If sales from your referrals aren’t appearing, please email us at info@irssolutions.com for assistance.

To terminate your account, email us at info@irssolutions.com with the subject line “Delete my account.” Please include the email address associated with your account and your reason for leaving