IRS Solutions Software

Partner Rewards Program Terms and Conditions

PLEASE READ THIS AGREEMENT CAREFULLY

THIS PARTNER REWARDS AGREEMENT IS A LEGAL AGREEMENT BETWEEN YOU (“AFFILIATE”) AND IRS ADVISORS, INC. (“IRS SOLUTIONS” or the “COMPANY”). TO PARTICIPATE, THE AFFILIATE AGREES TO INCLUDE CERTAIN MATERIALS TO PROMOTE THE COMPANY AND ENGAGE IN EMAILS AND SOCIAL MEDIA PROMOTION IN EXCHANGE FOR COMMISSION AS DEFINED BELOW (“PARTNER REWARDS PROGRAM” or the “PROGRAM”). BY REGISTERING FOR AND PARTICIPATING IN THE PARTNER REWARDS PROGRAM, YOU AGREE TO BE BOUND BY THE TERMS OF THIS AGREEMENT.

IRS Advisors, Inc. reserves the right to modify these Terms and Conditions at any time, at its sole discretion, with or without notice. IRS Advisors, Inc. may also, in its sole discretion, change, cancel, suspend, or modify any aspect of the Program with or without notice.

1. Eligibility and Participation

1.1 Eligibility

Both the Affiliate and the referred subscriber must be 18 years of age or older to participate in the Program. IRS Solutions, at its sole discretion, reserves the right to disqualify any interested parties in the Program.

1.2 Rewards Partner Acceptance

Upon receipt of a completed Affiliate application, IRS Solutions will notify the Affiliate of its decision to reject or accept participation in the Program. IRS Solutions may, at its discretion, request additional information before a decision can be made. This may require consultation with the Affiliate or a request to share certain document(s) before the application can be further reviewed. If IRS Solutions does not notify you that you are accepted to participate in the Partner Rewards Program within thirty (30) days from your application, your application is considered to be rejected.

If the Affiliate is accepted to participate in the Partner Rewards Program, then upon notification of acceptance, the terms and conditions of this Agreement shall apply in full force and effect, until terminated, pursuant to the terms set forth below. Further, the Affiliate will need to complete any enrollment criteria set out in Program Policies, if applicable.

At all times, the Affiliate will comply with the terms and conditions of this Agreement, including any applicable Program Policies.

2. Rewards Structure

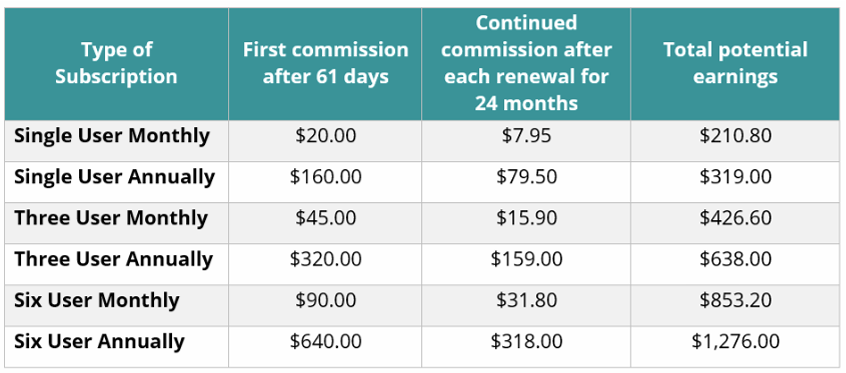

- Rewards Partners earn commissions for each new user referred to IRS Solutions Software, and who begins a paid subscription.

- Commissions are paid solely on payments processed successfully.

- The first commission payment is made during the third (3rd) month following the subscription start date (and after the 60-day money-back guarantee).

- Commissions are paid as follows:

- Dollar amount on the first payment

- 5% commission on recurring subscription orders from the referred subscriber for the 24 month period.

- Detailed commission structures are available on our website.

3. Customer Transactions

3.1 Partner Rewards Program Limits

IRS Solutions will pay the Affiliate commission, as described in the Rewards Partner Dashboard, for each new subscription acquired through one of the Affiliate’s links. The start of the subscription is determined by the date of the first subscription purchase (as applicable). The Affiliate will receive a commission payment for that Customer Subscription Transactions only, regardless of any additional purchases made by that customer during their subscription.

3.2 Acceptance and Validity

The Affiliate will only be eligible for a commission payment for any Customer Transactions that are derived from Rewards Partner leads generated by the Rewards Partner Link made available upon acceptance into the Program. A Rewards Partner Lead will be considered valid and accepted if, in the Company’s reasonable determination: (i) it is a new potential customer of the Company, and (ii) is not a previous or existing customer at the time of submission. Notwithstanding the foregoing, the Company may choose not to accept a Rewards Partner Lead in its reasonable discretion.

3.3 Commission and Payment

In order to receive payment under this Agreement, the Affiliate must have: (i) agreed to the terms of this Agreement, (ii) completed all steps necessary to create an account in the Rewards Partner Portal in accordance with specified directions, (iii) maintain a valid and up-to-date PayPal account, and (iv) completed any and all required tax documentation in order for the Rewards Partner Portal to process any payments that may be owed.

3.4 Requirements for Payment; Forfeiture

Notwithstanding the foregoing or anything to the contrary in this Agreement, if any of the requirements set forth in section 3.3(i-iv) remain outstanding for three (3) months immediately following the close of a Customer Transaction, then the Affiliate’s right to receive commission arising from any and all Customer Transactions with the associated Customer will be forever forfeited (each, a “Forfeited Transaction”). The Company will have no obligation to pay commissions associated with a Forfeited Transaction. Once the Affiliate complies with all requirements in section 3.3(i-iv), the Affiliate will be eligible to receive commission on Customer Transactions, as long as these Customer Transactions do not involve the same Customer associated with a Forfeited Transaction.

3.5 Commission Payment

The Company will determine the currency in which it pays commission (USD Dollar), as well as the applicable conversion rate. The Company will not pay more than one commission payment or other similar referral fee on any given customer transaction (unless we choose to in our discretion).

- Taxes – The Affiliate is responsible for payment of all taxes and fees (including bank fees) applicable to the Commission. All amounts payable by IRS Advisors, Inc. to the Affiliate are subject to offset by the Company against any amounts owed by the Affiliate to IRS Advisors, Inc.

- Commission amounts – The Company reserves the right to alter or change the commission amount.

4. Promotional Materials

IRS Solutions shall make available to Rewards Partner certain banner advertisements, button links, text links, and/or other graphic or textual material for display and use on the Affiliate’s website, emails and social media platforms (the “Promotional Materials”). The Affiliate shall also include a link from the Promotional Materials to IRS Solutions Software’s website, as specified by the Company.

4.1 Use of Promotional Materials

The Affiliate´s use and display of the Promotional Materials on the Affiliate´s website shall conform to the following terms, conditions and specifications:

- Rewards Partner may only use the Promotional Materials for the purpose of promoting IRS Solution´s website (and the products and services available thereon), and for linking to the Company’s

- The Promotional Materials will be used to link only to the Company’s website and to the specific page and address as specified by the Company.

4.2 License

IRS Solutions Software hereby grants to the Affiliate a nonexclusive, terminable, nontransferable license (the “License”) to use Promotional Materials as specified under the terms and conditions of this Agreement. The term of the License shall expire upon the expiration or termination of this Agreement. Affiliate shall use the Promotional Material for the sole purpose intended by this Agreement. This Agreement confers neither an express nor an implied license for the use of the Promotional Material other for any purpose intended under this Agreement. Affiliate acknowledges and agrees that it is not allowed to make, have, use, sell, license, develop or otherwise exploit any parts, products, services, documents, or information that embody in whole or part any of the Promotional Material, or use any such Information for any other purpose, without the express prior written permission of the Disclosing Party.

4.3 Intellectual Property

Company retains all rights, ownership, and interest in the Promotional Materials, and in any copyright, trademark, or other intellectual property in the Promotional Materials. Nothing in this Agreement shall be construed to grant the Affiliate any rights, ownership or interest in the Promotional Materials, or in the underlying intellectual property, other than the rights to use the Promotional Materials granted under the License, as set forth in Section 1 of “Promotional Materials.” Affiliate acknowledges and agrees that the Company has and will have exclusive proprietary and other rights in Promotional Materials, including without limitation any and all worldwide patent, copyright, trademark, trade secret (as defined by Del. Code Ann. tit. 6, § 2001), and other intellectual property rights, however and whenever arising (collectively, the “Proprietary Rights”). Each Party further acknowledges and agrees that: (i) no title or ownership of the Proprietary Rights are transferred to Affiliate by this Agreement; (ii) the Proprietary Rights are and shall remain the exclusive property of the Company; and (iii) the Affiliate shall not have any right or interest in the Proprietary Rights. Affiliate shall deliver to the Company or destroy, at the Company’s option, the Promotional Material and all material concerning the Proprietary Rights in tangible form: (i) upon the written request of Company; or (ii) upon the termination of this Agreement, and in both cases, Affiliate shall certify promptly and in writing to the Company that it has done so. The Affiliate will bear its own expenses associated with the return of the Promotional Material.

5. Affiliate Portal / Partner Rewards Program

“Partner Rewards Program Portal” means the Affiliate-designated ID/security-enabled control panel in which the Rewards Partner can access Affiliate information, including but not limited to:

- Dashboard

- Referrals

- Visits

- Banners, creatives and links;

- Payment history

6. Relationship of Parties

This Agreement shall not be construed to create any employment relationship, agency relationship, or partnership between Company and Affiliate. Affiliate shall provide services for the Company as an independent contractor. The Affiliate shall have no authority to bind the Company into any agreement, nor shall the Affiliate be considered to be an agent of the Company in any respect.

7. Non-Exclusivity

This Agreement does not create an exclusive agreement between IRS Advisors, Inc. and the Affiliate. Both the Affiliate and the Company will have the right to recommend similar products and services of third parties and be permitted to work with other parties in connection with the design, sale, installation, implementation and use of similar services and products of third parties.

8. Changes to Partner Rewards Program

The Company will make attempts to notify the Affiliate when changes are made to this Agreement. The Affiliate should periodically review the most up-to-date version of the Agreement posted on the IRS Solutions website. IRS Solutions may, at its sole discretion, modify or revise the Agreement at any time, and the Affiliate agrees to be bound by such modifications or revisions. Continued participation in the Affiliate Program following any such changes will constitute acceptance of the change.

9. Remedies for Breach

Notwithstanding Section 10 hereof, each Party understands and agrees that due to the unique nature of the Program, there can be no adequate remedy at law for any breach of such Party’s obligations hereunder, that any such breach may allow the Affiliate or third parties to unfairly compete with Company thereby resulting in irreparable harm to the Company and therefore that the Company shall be entitled to seek ex parte injunctive or other appropriate equitable relief without bond to remedy or forestall any such breach or threatened breach. Such remedy shall not be deemed to be the exclusive remedy for any breach of this Agreement but shall be in addition to all other rights and remedies available at law or in equity, including those provided in this Agreement, as set forth below.

10. Enforcement of the Agreement and Dispute Resolution

With the exception of the Parties’ rights as set forth in Section 9, the Parties hereby agree to resolve any dispute arising under this Agreement or related to any Party’s compliance with this Agreement, including without limitation any claims for breach of this Agreement, expeditiously and cost effectively in accordance with the provisions of this Agreement, as follows:

10.1 Notice, Negotiation and Mediation

A Party shall promptly provide written notice, under this Agreement, to the other Party of any good faith dispute arising under this Agreement (“Notice of Dispute”). The Parties shall negotiate in good faith to attempt to reach a resolution within thirty (30) calendar days after the receipt of the Notice of Dispute (“Negotiations”). If at the end of such thirty (30) calendar day period the dispute has not been resolved to the satisfaction of the Parties, then any Party may provide written notice to the other Party, pursuant to Section 11 hereof, of such Party’s demand that the Parties engage in mediation (“Mediation”) of the dispute pursuant to this Section 10. For purposes of Mediation, the Parties may appointment of Mitchel Goldberg or another neutral from Judicate West (Tel: 213-223-1113), as mediator. In the event the parties are unable to resolve their Dispute through Mediation, the matter will be adjudicated through binding arbitration (“Arbitration”) of the dispute pursuant to this Section 10. The Mediation shall be conducted in Los Angeles County, California, on a confidential basis pursuant to California law and procedure applicable to mediations. Any settlement reached through Mediation shall be in writing, shall provide a recital of the underlying dispute, the terms and conditions of settlement, including, if applicable, the payment of a monetary sum. A mediated settlement will be enforceable in a court of competent jurisdiction.

10.2 Arbitration

Subject to the provisions of Section 9 hereof, all claims and disputes arising under or relating to this Agreement which have not been resolved by the Parties pursuant to Section 10.1 are to be settled by Arbitration. The Arbitration shall be conducted in Los Angeles County, California, on a confidential basis pursuant to California law and procedure applicable to mediations and arbitrations. Any decision or award as a result of any such Arbitration shall be in writing, shall provide an explanation for all conclusions of law and fact and shall include the assessment of costs, expenses, and reasonable attorneys’ fees. An award of Arbitration may be confirmed in a court of competent jurisdiction.

10.3 JURY/TRIAL WAIVER/ARBITRATION

THE PARTIES, AND EACH OF THEM, WAIVE ANY RIGHT TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION ARISING OUT OF THIS AGREEMENT, OR ANY OF THE TRANSACTIONS CONTEMPLATED HEREIN OR THEREIN, INCLUDING WITHOUT LIMITATION CONTRACT CLAIMS, TORT CLAIMS, BREACH OF DUTY CLAIMS, AND ALL OTHER COMMON LAW OR STATUTORY CLAIMS AND TO RESOLVE ALL CLAIMS, CAUSES AND DISPUTES THROUGH FINAL AND BINDING ARBITRATION TO BE HELD AS PROVIDED UNDER SECTION 10.2 ABOVE. EACH PARTY RECOGNIZES AND AGREES THAT THE FOREGOING WAIVER CONSTITUTES A MATERIAL INDUCEMENT FOR IT TO ENTER INTO THIS AGREEMENT. EACH PARTY REPRESENTS AND WARRANTS THAT IT HAS REVIEWED THIS WAIVER WITH ITS LEGAL COUNSEL AND THAT IT KNOWINGLY AND VOLUNTARILY WAIVES ITS JURY TRIAL RIGHTS FOLLOWING CONSULTATION WITH LEGAL COUNSEL.

10.4 Confidentiality

The Parties agree that any Negotiations under Section 10.1 or Arbitration under Section 10.2 of this Agreement are being conducted in accordance with the protection of the settlement privilege. All aspects of any such proceedings (including but not limited to all statements, testimony, submissions, and written materials of, or submitted on behalf of, any of the Parties or an arbitrator) are privileged and confidential and shall not be disclosed to any other person, except for their respective representatives, counsel and insurance carriers. The Parties further agree that the provisions of Sections 1152.5 and 1115 et seq. of the California Evidence Code and Federal Rule of Evidence 408 shall apply to any such Negotiations or Arbitration for breach of any subsequent settlement agreement in which they participate, provided, however, that the terms and details of such proceedings may be disclosed as necessary to enforce any settlement agreement reached in those proceedings or as ordered by a court or other tribunal of competent jurisdiction.

10.5 Attorneys’ Fees

If any legal action or proceeding is commenced in connection with any dispute arising under, relating to, or otherwise concerning this Agreement, the prevailing Party, as determined by the court or arbitrator, as applicable, shall be entitled to recover its attorneys’ and experts’ fees and all costs and necessary disbursements actually incurred in connection with such action or proceeding; provided, however, in the event an action or proceeding is commenced, other than for injunctive relief pursuant to Section 9, without first following the requirements of Section 10.1 or 10.2, the prevailing party will not recover their attorneys’ and experts’ fees and costs.

11. Notice

Any notice under this Agreement shall be in writing and shall be effective only if it is delivered by hand or mailed, certified or registered mail, postage prepaid, return receipt requested, addressed to the appropriate Party at its address set forth on the signature page to this Agreement. Any such notice shall be effective only upon actual receipt by the Party to be notified.

12. Termination

Either party may terminate this Agreement at any time, with or without cause, by giving the other party thirty (30) days written notice of termination. The Company may terminate this Agreement without cure of the Notice of Default provided for under Section 10(A), above. This Agreement terminates upon the Company seeking to enforce its remedies under Section 9, above. If this Agreement is terminated, the Affiliate will immediately cease use of, and remove from their website, all links to the IRS Solutions Software site, and all of the Company’s trademarks, trade dress, logos, and other materials provided by or on behalf of the Company to the Affiliate in connection with the Partner Rewards Program. All Commissions earned by the Affiliate through the date of termination will remain payable, only if related orders are not cancelled or returned. The Company may hold the Affiliate’s final payment for a reasonable time to ensure the correct amount is paid. Notwithstanding the foregoing, the Affiliate’s obligations with respect to the Program shall survive termination of this Agreement until the later of 5 (five) years from the date of the termination of this Agreement.

13. Amendment: Assignment

This Agreement shall not be modified, supplemented or amended except by a writing signed by both Parties hereto. Neither Party may assign or transfer this Agreement or any of its rights hereunder, or delegate any of its obligations hereunder (whether by merger, operation of law or in any other manner), without the prior written consent of the other Party, which consent may be withheld at such other Party’s sole discretion. Subject to the foregoing, this Agreement shall be binding upon the Parties hereto, and shall inure to the benefit of their respective successors and permitted assigns.

14. Governing Law: Service of Process

This Agreement shall be governed by, construed and enforced in accordance with the laws of the State of California, without regard to its choice of law provisions. The Parties hereby submit to the personal jurisdiction of California and agree that except for Negotiations pursuant to Section 10(A) hereof (which Negotiations may take place through any location/method of communication mutually agreed upon by the Parties), or an Arbitration pursuant to Section 10(B) hereof, any legal proceeding or other action contemplated by this Agreement shall be brought solely in a state or federal court of competent jurisdiction in the County of Los Angeles, California.

15. Severability

If any provision of this Agreement is found by a proper authority to be unenforceable or invalid, such unenforceability or invalidity shall not render this Agreement unenforceable or invalid as a whole, and in such event, such provision shall be changed and interpreted so as to best accomplish the objectives of the unenforceable or invalid provision within the limits of applicable law or applicable court decisions.

16. Entire Agreement: Counterparts

Each undersigned person is authorized to enter into this Agreement on behalf of its Party and understands that the other Party is relying upon this representation of authority to enter into this Agreement. This Agreement constitutes the entire agreement and understanding of the Parties with respect to the subject matter hereof, and supersedes all prior and contemporaneous negotiations, discussions and understandings of the Parties, whether written or oral. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

17. PayPal Terms and conditions

Please refer to PayPal’s policy to ensure that you are eligible to receive payment:

PayPal User Agreement

IRS Solutions is not responsible for paying any third party fees imposed by PayPal, your bank, or anyone else for you to receive affiliate commission fees.