Plans and Pricing for IRS Tax Resolution Software

Everything you need to succeed is built into one low membership fee. No extra charges or hidden costs.

Which Plan Fits You Best?

No hidden fees. Everything is included!

Switch or cancel* anytime

Enterprise

-

We were designed with you in mind.

-

Call us for a quote today!

Small Firms

-

3 Users for the price of 2

-

12 months for the price of 10

-

Savings of over $2,500

Mid / Large Firms

-

6 Users for the price of 4

-

12 months for the price of 10

-

Savings of over $5,000

Enterprise

-

We were designed with you in mind.

-

Call us for a quote today!

*Effective at the end of the billing period

Try IRS Solutions® 100% Risk-Free

Let us show you how IRS Solutions can transform your tax practice.

What’s Included?

One Membership Fee Gets You All This and More

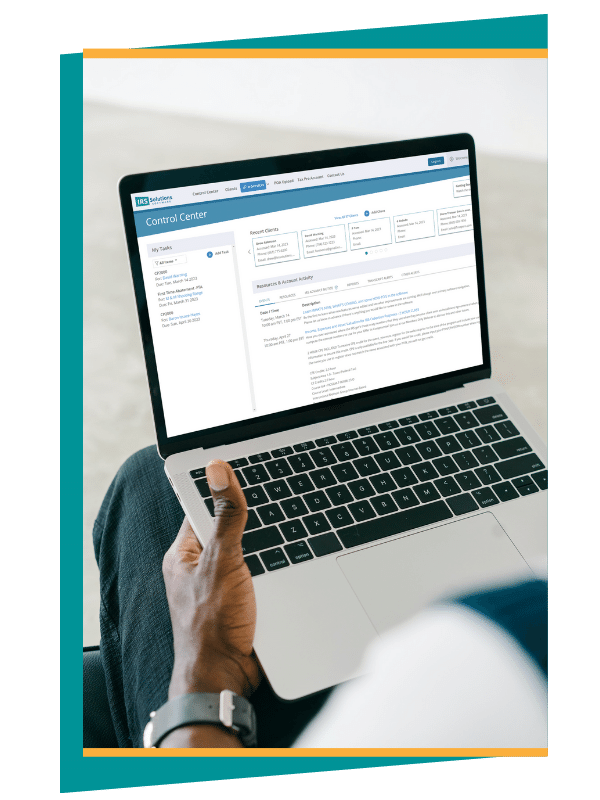

- User-friendly, easy-to-understand interface

- IRS Advance Notice, the state-of-the-art way to know about transcript changes and upcoming actions

- Customized invoicing

- CPACharge© to manage payment processing

- Your firms Dedicated Client Portal, branded with your logo and a custom URL

- Data security via AWS Government Cloud

- Detailed reporting on demand

- Customized client communication tools

- Your customers can easily complete their financial information

- Automatic Transcript download

- 20+ State POAs, and more coming all the time

- Software support from our friendly experts

- Exclusive access to the IRS Solutions online community of colleagues

Plans & Billings FAQ

Got Questions, We've got answers?

Unlike other tax resolution software providers that tack on additional charges for critical features, IRS Solutions includes everything you need to succeed for one low membership fee.

As tax pros, we know what it takes to provide tax resolution services. You can’t do your job without transcript delivery, reporting, and other similar functions. We don’t charge extra for basic features like these. They’re built into your membership fee.

We’re so confident in the IRS Solutions platform, community, and unrivaled support that we back our product with a money-back guarantee. If you’re not completely satisfied with IRS Solutions during the first 60 days* of your annual membership, simply request a refund by contacting our customer support, and we’ll cancel your membership and refund your subscription charges.

*Please note that this policy does not apply to renewal memberships. Refunds must be requested within the 60-day period to be eligible.

A single-user IRS Solutions license supports one login per session. If your practice requires multiple employees to access the platform simultaneously, please consider signing up for a multi-user license.

What Our Customers Say About Us

It's easy to see why tax professionals choose IRS Solutions!

The Only Platform Built by Tax Pros for Tax Pros

IRS Solutions team members personally manage numerous real-life resolution cases every year. This keeps us current on tax laws and constantly-changing IRS regulations to ensure that we always offer the best and most innovative resolution software to meet your needs.

Partnerships and Integrations

We work with the tax industry’s best and have developed a network of partnerships and integrations,

united by a shared commitment to provide cutting-edge resources for tax professionals.

Industry Insiders Agree

IRS Solutions Software is consistently very highly rated by Tax Resolutions Specialists, Enrolled Agents, and Accounting Professionals who trust and prefer our value, functionality, features and exceptional member support.